ALICE® stands for Asset Limited, Income Constrained, Employed — a large population of hardworking residents who work at low-paying jobs, have little or no savings and are one emergency away from falling into poverty.

For Callie, she never expected to find herself struggling to make ends meet. As a hardworking single mother, she was doing everything she could to provide for her daughter, Riley. But despite her best efforts, financial stability always seemed just out of reach. Bills piled up, childcare costs stretched her budget to the limit, and unexpected expenses left her constantly playing catch-up.

It wasn’t until she spoke with one of Riley’s teachers that she learned about the resources available through Burke County United Way—and everything began to change.

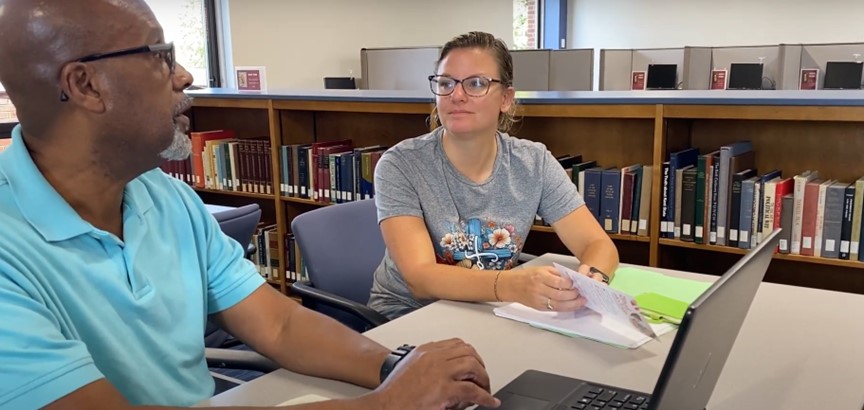

In July 2024, Callie started working with Keith Conley, a certified Financial Coach through Burke County United Way’s Financial Empowerment Program. With his guidance, she learned about tools and resources she had never considered. One of the first steps was applying for Medicaid expansion for Riley. While she didn’t qualify for food stamps, the Medicaid approval saved her $255 per month on healthcare expenses—money that could now go toward other necessities.

She also started budgeting in a whole new way. Keith introduced her to a spending plan that helped her track every dollar. Before, she would spend money at the beginning of the month without fully accounting for what she had left for the rest of it. Now, she has set aside funds for groceries, gas, bills, and even Christmas presents, making it easier to stay on track. She also built an emergency fund, automatically depositing $200 each month. Over time, she’s saved $1,000—something that once felt impossible.

Burke County United Way also provided Childcare Assistance, covering $6,000 worth of expenses. Without it, Callie doesn’t know how she would have managed. The cost of summer childcare alone could have forced her to make difficult choices between paying rent, buying groceries, or keeping Riley in a safe and enriching environment.

Another major hurdle she faced was debt. Her credit score had dropped to 560 after relying on credit cards for everyday expenses. But with Keith’s support, she paid off debt, reduced her debt-to-income ratio, and increased her credit limit to improve her score. By sticking to her spending plan and making strategic payments, her credit score rose to 630. With this improvement, she’s now working with a mortgage lender to begin searching for a home—a dream she never thought would be within reach.

But perhaps the most transformative part of Callie’s journey is the sense of hope she now carries. She recently earned a promotion at work, and although the pay increase was small, she feels more financially secure than ever before. Beyond that, she’s been pursuing her long-term goals, continuing her education at Appalachian State University to earn a degree in social work.

Callie’s journey is a testament to the power of financial empowerment and community support. Thanks to Burke County United Way, she has the tools to build a stable future for herself and Riley. Without these resources, she knows she would have continued down a difficult path, but today, she stands filled with hope, ready for what comes next.

To learn about more stories like Callie’s and to read the ALICE® NC Report, visit UnitedForALICE.org, UnitedWayNC.org, and CarolinasFoundation.org.